The Maquiladora Industry (IMMEX) in 2020-2021

Companies in the maquiladora and manufacturing industry faced a number of changes in 2020. Alejandro Martínez share the following insights on the maquiladora industry.

At the end of 2020, Mexico’s Harmonized Tariff System was amended and the trade identification numbers (NICOs, acronym in Spanish) entered into force. In short, a NICO is a tariff item at a 10 level digit. As a result, the import-export-oriented manufacturing industry, commonly referred to the IMMEX industry, will have to include the new NICOs in their trade and customs permits, authorizations, filings, etc.

In late 2020, a government document was published indicating the dates that companies need to start including NICOs in the procedures for new programs, extensions, etc. However, NICOs are not relevant for other bureaucratic filings, such as updating a company’s tax address or facilities.

Ever since the Mexican Single Window of Foreign Trade (“VUCEM”) reponed on the first business day of January 2021, all new bureaucratic trade-related formalities must contain tariff fractions with NICO.

As far as bureaucracy is concerned, 2020 was a challenging year for the IMMEX industry. Companies with a long track record needed to make serious changes because they faced various obstacles on behalf of Mexico’s customs authority (SAT). In my experience, I saw some IMMEX companies that had to submit four times their tax address application because they were unable to receive a positive determination on behalf of the customs authority.

Mexican Authorities Hostile Against Lawyers and Advisors

The authority informed the company that they must carry out their application on their own, without their attorney or advisor. Apparently, the customs authorities do not like companies to appoint advisers in the bureaucratic process. If a company does not have proper advice, the customs authority may deny the permit because the application had one or more minor issues. For example, the company may submit incorrectly the proper measurements of the property.

Ministry of Economy and IMMEX

As noted in a future post, the Ministry of Economy established that imported products must comply with mandatory standards at customs. Despite this change and others, the IMMEX and PROSEC Programs remain a very important instrument for the manufacturing industry because their imported products, which are subject to additional processing, can benefit from the exception for non-compliance of the standards.

Today, I believe that companies in the maquiladora and manufacturing industry have already learned how to do their paperwork. And, I hope that the customs authority will be able to rely and trust more on companies in 2021. In my firm, we believe that the authority will start noticing that there are also companies that follow good practices, although this becomes complicated with over-regulation.

With regard to the law initiative that threatens to disappear (or restrict significantly) labor outsourcing, I believe that many IMMEX companies are going to suffer if the said initiative is adopted as such.

In particular, the IMMEX companies that executed an outsourcing agreement to access the IMMEX program will very likely require to respond to information requests on behalf of the authority. Surely, the customs authority will ask the IMMEX company about the employment status of their personnel to verify that the company indeed modified its human resources department.

In the event that this law initiative is adopted, companies should not submit notices on their own and without proper advice. If there is something in the application, the authority may detect mistakes or inconsistencies that can eventually affect the company.

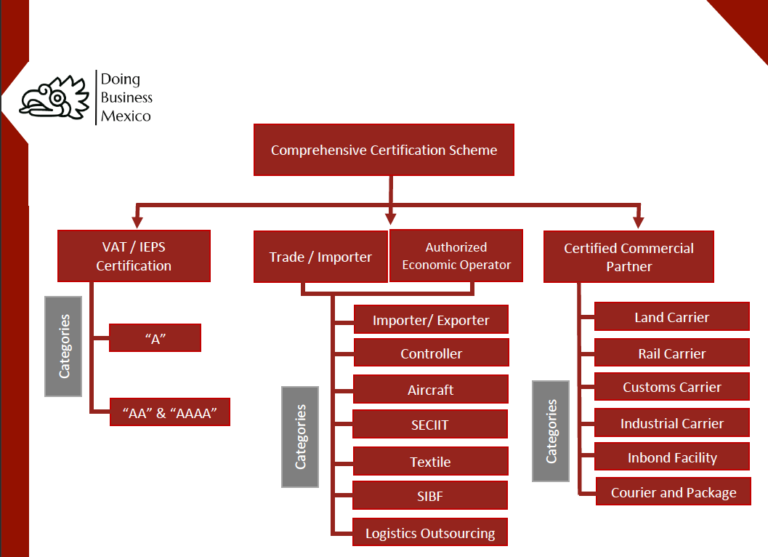

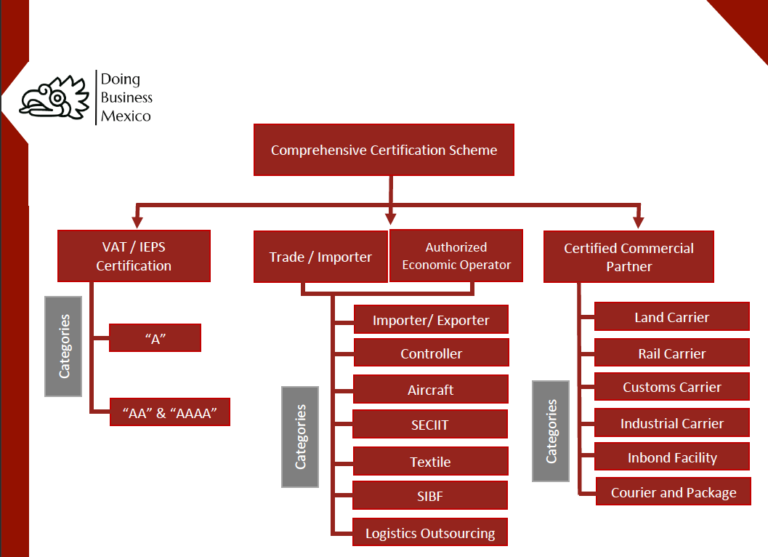

In 2020, the General International Trade Rules of the Tax Administration Service (“SAT”) were subject to significant changes, particularly the comprehensive certification scheme.

Trade Facilitation for Maquila Companies?

Specifically, the SAT made the first amendment to the Rules in July. Among the amendments, SAT eliminated, on the one hand, various benefits and items in the VAT/IEPS certification. On the other hand, SAT retained some benefits for the Authorized Economic Operator (“AEO”) but others were permanently eliminated from the Comprehensive Certification Scheme.

In addition to the elimination of VAT refunds and other changes, AA and AAA companies under the VAT /IEPS Certification no longer enjoy certain trade facilitation measures, such as the period of stay for temporal imports of 36 months and the immediate registration to specific product importer roll. These trade facilitation measures were passed to the AEO.

Additional Fees and Other Charges

In addition, the SAT added obligations, including an annual fee for renewing the certification. In other words, these companies must pay a fee of approximately 30,000 pesos that all certified companies must now make, even if they certification has not yet been renewed.

Subsequently, the SAT surprised the IMMEX community when requesting a retroactive payment of fees pertaining to the Comprehensive Certification Scheme. Obviously, this situation complicated and impacted the maquiladora industry. In my firm, we consider it important to pay this “retroactive payment” so that companies do not have problems when renewing their certifications. However, it is possible to legally challenge this payment.