Foreign Investment

A Guide to Foreign Investment in Mexico

Foreign Investment in Mexico: A Snapshot

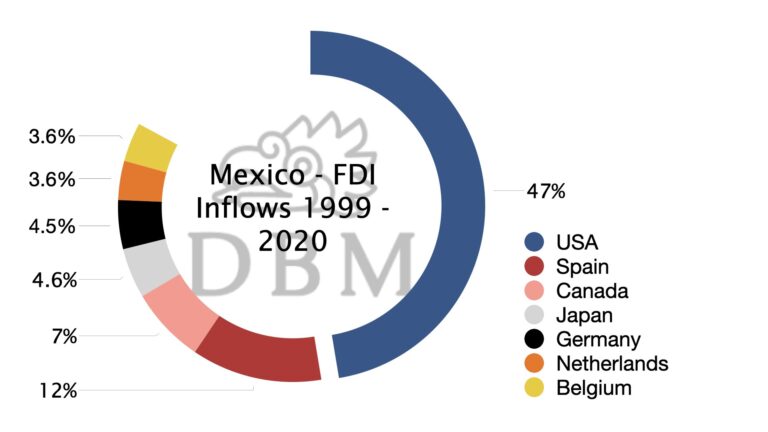

Mexico is an open economy that embraces foreign investment. According to foreign direct investment (FDI) statistics from 1999-2020, almost half of Mexico’s FDI comes from the USA, followed by Spain, Canada, Japan, and Germany.

Top Foreign Direct Investment Inflows per Country.

Despite being a major exporting capital country in the world, China is not a major source of FDI in Mexico.

Interestingly, Chinese investment in Latin America and the Caribbean has had a sharp increase since 2010. However, that has not been the case in Mexico since Chinese investment only represents around 0.2% of the total FDI in Mexico.

For more information, about Chinese investment in Latin America, mainly focused on oil and natural resources, CEPAL (Economic Commission for Latin America) issued an interesting publication.

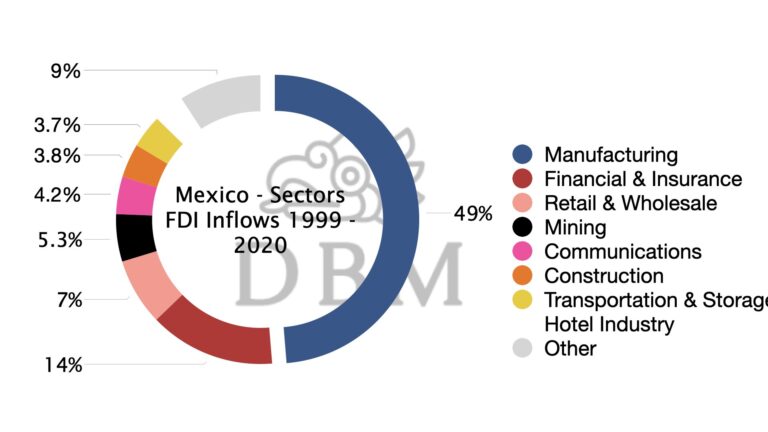

Foreign Direct Investment Inflows at an Economic Sector Level.

As for economic sectors, FDI inflows have focused mainly on the manufacturing sector, followed by financial services, international trade, mining, construction, transportation, and hotel industry.

Do Foreign Investment Restrictions Apply?

In the following section, Doing Business Mexico will provide an overview on foreign investment restrictions applicable to economic sectors and the role of the authorities regarding investment authorizations.

If you wish to avoid reading or you need a quick answer, complete our survey and we will be able to provide a Free Preliminary Assessment on whether a possible investment is subject to restrictions in Mexico.

Prohibited and Restricted Economic Sectors for Foreign Investment in Mexico

From a practical standpoint of view, the Foreign Investment Law (FIL) expressly prohibits foreign investment in “ten” general economic sectors that are classified as “activities reserved to the Mexican State” or “activities reserved to Mexicans”.

Activities Reserved to the Mexican Government

Foreign investment cannot participate, directly or indirectly, in these economic sectors and, thus, foreign investors cannot hold ownership interests in an enterprise in these economic sectors or activities.

- Nuclear power generation.

- Radioactive minerals.

- Telegraph and radiotelegraph services.

- Postal service.

- Banknotes issuance.

- Coin issuance.

- Control, supervision, and surveillance of ports, airports, and heliports.

Needless to say, the FIL also provides that exploration and extraction of oil (and other hydrocarbons), as well as the transmission and distribution of electricity, are reserved to the Mexican Government per the Constitution. However, foreign investment may participate in said economic sectors or activities provided that the relevant energy authority grants an authorization.

Activities Reserved to Mexicans:

Likewise, foreign investment cannot participate directly in the following economic sectors:

8. Domestic land transportation of passengers, tourists, and freight transport, while courier or packaging services are excluded.

9. Development banks.

10. Professional and technical services, such as public brokers, customs broker, pesticide services, medical services to Mexican enterprises, restrictions may also apply based on international reciprocity, among others.

Economic Sectors with Foreign Investment Restrictions in Mexico.

The FIL provides the following ownership interests limitations or caps to foreign investors in Mexican enterprises that may not be exceeded directly or indirectly in the following regulated activities:

Up to 10% participation limit or cap:

- Cooperative Production Enterprises.

Up to 49% participation limit or cap:

- Manufacture and commercialization of explosives, firearms, cartridges, munitions, and fireworks, excluding the preparation of explosive mixtures for industrial and extractive activities.

- Printing or publication of daily newspapers written primarily for a Mexican audience and distributed in the territory of Mexico.

- Ownership of land shares of agricultural, livestock, or forestry purposes enterprises.

- Coastal fishing, freshwater fishing, and fishing in the Exclusive Economic Zone, excluding aquaculture.

- Mexican enterprise authorized to act as an integral port administrator.

- Mexican enterprises engaged in the supply of piloting port services to vessels operating in inland navigation.

- Mexican shipping enterprise or Mexican vessels which are engaged in the commercial exploitation of vessels for inland and cabotage navigation, excluding tourism cruises and exploitation of dredges and maritime devices for the construction, preservation, and operation of ports.

- Supplying of fuel and lubricants to vessels, airplanes, and railway equipment.

- Broadcasting (radio and free to air television). The 49% interest ownership cap shall apply according to the reciprocity existent with the country in which the investor or trader who ultimately controls the enterprise, directly or indirectly, is constituted.

- Telecommunications concessionaire companies as provided by Articles 11 and 12 of the Federal Telecommunications law.

- Enterprises that supplies a scheduled and non-scheduled domestic air transport service, a non-scheduled international air transport service in the modality of air taxi, or a specialty air service.

Regulated Activities that require a favorable resolution to have more than 49% ownership interests:

- Supplying port services to vessels for inland navigation such as towing, mooring, and lighterage (or tendering).

- Mexican enterprise engaged in high-seas navigation services and port towing services

- Mexican enterprise that is a concessionaire or permissionaire of airfields for public service.

- Pre-school, primary, secondary, high school, higher, and combined private educational services.

- Legal Services

- construction, operation, and exploitation of railroads deemed general means of communication, or in the supply of railway transportation public service.

Foreign Investment Reviews in Mexico?

Mexico has foreign investment reviews in place, but they differ from those carried out in other jurisdictions. United States, Canada, and China, for instance, have reviews that are triggered by “national security” concerns.

National security concerns are not a cause for a review in Mexico. Rather, the FIL expressly provides when the National Commission for Foreign Investment (CNIE, acronym in Spanish) shall carry out a review as well as the criteria to issue a favorable resolution. The criteria to issue a favorable resolution resembles, to a certain extent, the Canadian “net-benefit” test.

Per the FIL, CNIE will issue its resolutions per the following criteria:

- The impact on employment and employee training;

- Technological contribution;

- compliance on the applicable environmental law; and,

- contribution to increasing the competitiveness of the country.

Needless to say, CNIE has the power to block a foreign investment based on national security grounds, however, this power has never been used.

The Ministry of Economy, on the other hand, is the authority in charge of authorizing neutral investment.

Foreign Investment Review: Regulated Activities.

CNIE must issue a favorable government resolution when a foreign investor seeks to have more than 49% of ownership interests in an enterprise under the regulated activities that were listed in Regulated Activities that require a favorable resolution to have more than 49% ownership.

Foreign Investment Review in Mexico: Investment Cap.

The CNIE annually determines a ceiling that may trigger a review as a result of an acquisition on behalf of foreign investment. For instance, a foreign investor would have to submit an application when the total value of the assets for which it intends to acquire exceeds $20,184 million pesos (about 874 million USD).

Per the FIL, the CNIE may impose restrictions on the acquisition provided that they do not distort international trade. As reported in Mexico’s Trade Policy review in 2016, the CNIE has so far not rejected any investment subject to this review.

Neutral Investment

The FIL introduces the concept of “neutral investment” that allows foreigners to invest in regulated activities (see Economic Sectors with Foreign Investment Restrictions in Mexico).

In the context of companies or economic activities, the neutral investment mechanism allows foreign investors to have ownership of special interests or shares that grant economic rights or benefits but restricts non-economic corporate rights, such as the right to vote and/or the appointment of foreign managers on the board.

The Ministry of Economy and, as appropriate, the National Banking and Securities Commission will approve the applications for neutral investment.

Our Most Popular Guides

IMMEX Program

The IMMEX program is, to a great extent, used by companies within the manufacturing industry. In this guide, IMMEX experts provide a general overview of the IMMEX program and other trade instruments.

Taxes in Mexico

In this tax guide, our tax experts explain the income tax for individuals as well as the corporate tax rate. We also explain when Tax authorities consider that foreigners have a source of income in Mexico.

Starting a Company in Mexico

Our contributors explain the 12 steps to set up a company in Mexico. In this business guide, we also explain the different types of legal entities and other business models.

Foreign Investment in Mexico

As a general rule, all sectors of the economy are open to foreign investors unless Mexico's Foreign Investment Law provides restrictions. In this guide, our experts inform those foreign investment restrictions on land, activities, and certain legal entities.

Get In Touch With Us!

Phone

+ 52 55 1683 2289

info{@}doingbusiness-mexico.com

Address

Rio Churubusco 601, Col. Xoco, Benito Juarez, Mexico City.