Labor in Mexico

A Guide to Labor in Mexico

Labor Law in Mexico

Mexico’s labor framework is set forth in the Constitution and the Federal Labor Law (hereon “Labor Law”). Accordingly, a “job” or “working relation” is defined as:

…the rendering of a subordinated personal service to another person in exchange for a wage. (Article 20 of the Labor Law.)

The job definition is quite broad because any person that renders a subordinated service to another, who in turn pays compensation, is deemed as an employee, regardless of the nature of the service performed, and he or she is entitled to labor rights.

Mexican Labor-Related Laws and Regulations

In addition to the Labor Law, Mexico has the following labor-related laws or regulations that complete its regulatory framework:

- Social Security Law;

- Retirement Savings System Law;

- Institute of the National Housing Fund for Workers Law (INFONAVIT Law);

- Federal Regulation on the Safety, Hygiene, and Environment at the Workplace;

- The Mandatory Standard NOM-035-STPS-2018 on Psychosocial Risk Factors at Work – Identification, Analysis and Prevention, establishing the elements to identify, analyze and prevent psychosocial risk factors, as well as to promote an environment organizational support in the workplace. (Published on October 23, 2018, in the Official Gazette).

The employers are required to register all of their employees before Mexican public institutions, namely the Mexican Social Security Institution (IMSS, acronym in Spanish), the National Housing Fund for Workers (INFONAVIT, acronym in Spanish), and the National Fund Institute for Workers’ Expenditures (FONACOT, acronym in Spanish). As a result, an employer has to pay “social-taxes” to these agencies. Failing to register or making timely payments regarding these social-taxes, the employer is subject to penalties and surcharges.

Also, the employer will have to register before the tax or treasury authority of the State (i.e. local authority). States collect a Payroll tax that the employer pays based on wages and other expenditures.

Salary and Wages in Mexico

High Labor Costs in Mexico?

Pursuant to the Labor Law, workers are entitled to numerous labor rights. Employees are entitled, for instance, to profit sharing, and they can only be dismissed in a limited number of cases.

If a worker is terminated without a justified cause, he or she is entitled to seek job reinstatement or severance pay, which foreign investors perceive Mexican Labor Law as “overprotective” and costly.

The Minimum Wage in Mexico

The Labor Law provides the existence of a general minimum daily wage, which is defined as the minimum amount of money that a worker must receive for services rendered within a working day.

The National Commission on Minimum Wages (CONASAMI), which is made up of government officials, workers, and employers representatives, is responsible to establish a minimum wage in Mexico.

Mexican Minimum Wage in Dollars (USD)

The general minimum wage for 2025 is about 13 USD, and it is applicable mostly throughout the country, except for the Northern Border Strip. The Northern Border Strip is subject to a higher minimum wage, about 20 USD per workday during 2025.

Do Employers or Companies Pay the Minimum Wage in Mexico?

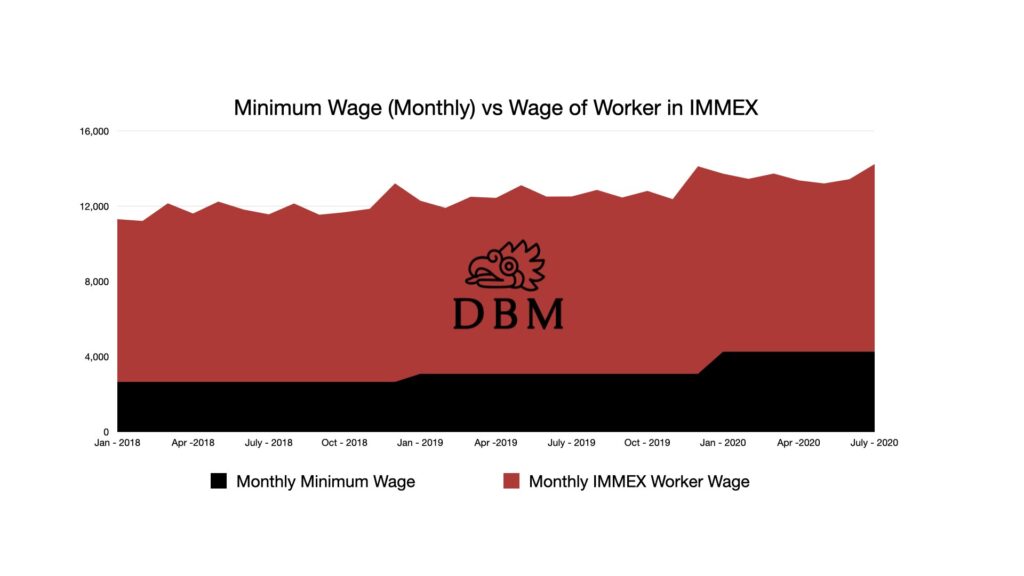

Jobs in Mexico are normally subject to wages above the minimum wage, particularly in cities and the manufacturing sector. For instance, the wage of workers in the IMMEX companies (excluding administrative personnel, “social taxes”, and welfare benefits) earn more than double the minimum as noted in our chart.

Individual Employment or Labor Agreements

The Labor Law provides that the employer is responsible to have each and every single individual employment agreement in writing. Failure to have records and the contracts, the employer may face not only fines on behalf of the Mexican Labor authorities but also costly consequences in the event of a labor dispute.

The employment agreements or contracts have to include mandatory information, such as the employee’s name, the wage, place of work, description of employment activities, duration of the contract, work hours, vacations, among other vital information.

Duration of Labor Contracts

As a general rule, the Labor Law establishes that an individual employment agreement duration is indefinite (i.e. permanent).

Are Temporary Contracts Allowed in Mexico?

Temporary contracts are permitted, however, only when there is a justified cause, such as probationary periods, initial training, among other specific situations.

How Many Work Hours Are Allowed?

The weekly work hours are determined by the work shift. The day, night, and mixed shifts entail eight, seven, and seven and a half working hours, respectively, and all shifts include a half-hour break.

Over-Working Hours in Mexico

Mexican Law allows over-working hours, but the following restrictions apply. Employees may carry out a maximum of 3 “extra” working hours per day, but an employee can only do extra working hours 3 times during a week; that is, a total of 9 “extra” working hours distributed in a week.

The Value of an Over-Working Hour

The over-working hours are paid double the normal hour.

Exceeding the Maximum Over-Working Hours Limit

In the event that the employee exceeds the maximum of 3 “extra” working hours in a day or the 9 “extra” working hours in a week, the additional hour(s) are paid triple the normal hour.

Mandatory Rest Days in Mexico

Wages are calculated on a seven-day week, but an employee is entitled to one day of rest, preferably Sunday, for every six-day work period with full pay. If the employee works on Sunday, a 25% bonus to his daily wage applies.

Labor Rights and Premiums in Mexico

In addition to wages, employees are entitled to additional “payments” or rights, such as the year-end bonus (aguinaldo), vacations, vacation premium, among others. The Labor Law provides that these rights cannot be waived in the employment agreements.

The Year-End Bonus (or Aguinaldo)

When the employee has worked throughout the year with the employer, the year-end bonus (aguinaldo) shall be equivalent to 15 days of salary at least. The employer has to pay the year-end bonus on the 20th of December at the latest.

Vacations: How Many Days Must an Employer Give in Mexico?

Furthermore, an employee typically receives six days of vacation, which is the minimum required by law, when he or she has worked for a year with the employer.

As his or her seniority increases, the employee is entitled to more vacation days. In the beginning, the employee will increase two days of vacations each year of work during the first four years and, thus, having the right to enjoy 12 days of vacations. After his or her fourth year, the employee will continue collecting additional two additional days of vacations every five years of work.

Vacation Premium

When the employee enjoys his vacation days, the employer has to pay the regular daily wage for each day of accrued vacation, plus the vacation premium equivalent to 25% the daily wage.

Foreign Employees

Requirements for Hiring Foreign Employees in Mexico

Mexican employers may hire foreign employees, provided that they have been authorized by the National Institute of Migration (INM, acronym in Spanish). However, the Labor Law provides that employers must comply with the Mexican-foreign employees nine to one ratio requirement. In other words, Mexican employees must represent at least 90% of the business’s workforce in Mexico.

Exceptions to the Foreign Employees Ratio Rule

The Labor Law provides some exceptions to the Mexican-foreign employees ratio rule. For example, the Mexican Labor Law provides that if there are no Mexican technicians or professionals, the company may temporally hire foreigners with the required expertise for the specific service.

High-Level Foreign Officers

Another important exception applies to high-level foreign officers of Mexican entities, who are exempted from the nine to one ratio requirement.

Migration Aspects For Employers and Employees

The Migration Law provides several ways through which a foreigner may eventually obtain a permanent residency migration status in Mexico.

Investor Visa

The investor visa, for instance, requires a foreigner to invest a certain amount either in an existing company or when incorporating a Mexican company. A foreigner with an investor visa may eventually have a permanent residency, but having such migratory status is a gradual process that takes a couple of years.

Resident Visa

The law also introduces a resident visa for a foreigner that has made a real estate investment. Similar to the investor visa, the foreigner would obtain first a temporary residence visa, and he or she may have access to the permanent visa after several years, provided the conditions are met.

Authorization for Employers to Hire Foreigners

A company that seeks to hire a foreigner as a worker must have a “permit” on behalf of the National Institute of Migration (INM, acronym in Spanish). Once authorized, the company can issue employment offers to foreigners, who will have to apply for a temporary residence visa or, if applicable, a permanent visa.

Failure to comply with the Migration Law, the company may face harsh penalties.

Outsourcing in Mexico

A Labor Outsourcing Reform in Mexico was published in the Official Gazette on Friday, April 23, 2021, with huge implications on Labor and Tax matters. The main changes to the Federal Labor Law are the following:

1. Labor Outsourcing or Subcontracting Prohibited

Labor subcontracting (outsourcing and insourcing) is prohibited.

2. Employment Agencies and Intermediaries

Employment agencies or intermediaries involved in the personnel hiring process may participate in the recruitment, selection, training and qualification, since they are not considered employers.

3. Specialized Services Agreement

The provision of specialized services and execution of specialized works is allowed, but certain conditions have to met. For instance, the specialized services must not be part of the corporate purpose or the main economic activity of the beneficiary. However, the company providing such service (the “contractor”) must registered in the public registry maintained by the Ministry of Labor. In order to obtain the registration, the company must prove that it is up to date with its tax and social security obligations. The company has to renewed its registration every 3 years.

4. Companies Within the Same Group

Complementary or shared services or works rendered between companies of the same business group will also be considered as specialized as long as they are not part of the corporate purpose or the main economic activity of the company that receives them.

5. Joint Responsibility

A company that benefits from the specialized services or the execution of specialized works is jointly liable with the contractor that fails to comply with the tax and social security obligations (IMSS, INFONAVIT, SAT, etc.) regarding the involved workers .

6. Profit Sharing with Workers

With respect to Profit Sharing payments (PTU, acronym in Spanish), the reform established a maximum limit of three months of the employee’s salary or the average PTU payment in the last three years, whichever is the most favorable for the employee. The Profit Sharing formula did not change.

7. Fines

The reform established administrative fines equivalent to 50,000 UMAS (as of today, approximately 450,000 pesos) to those companies that fail to comply with the labor obligations, regardless of other social security, tax or criminal penalties.

More Information on the Labor Outsourcing Reform

Termination of Employment

Scenarios of Employment Relationship Termination

Voluntary Resignation

Voluntarily resignation, of course, implies without undue pressure on behalf of the employer.

Dismissal with Just Cause

For instance, an employer is authorized to fire an employee that steals from the employer, an employee that performed a “violent” act against his colleagues or the employer, among other situations as indicated in the Labor Law.

Dismissal Without Just Cause

A dismissal with just cause may become a dismissal without just cause if the employer fails to carry out the dismissal process as indicated in the Labor Law.

Employee Terminates with Just Cause

The employee may terminate the agreement under specific grounds as provided in article 51 of the Labor Law, for instance, wage reduction, misleading conditions of employment.

Redundancy or Severance Package

The redundancy costs or severance package payment is subject to specific rules that may vary depending on the termination scenarios.

In any employment relationship termination scenario, the employee is always entitled to receive a severance payment from the employer, commonly referred to as the “finiquito“.

The finiquito is composed of the following:

- Accrued and unpaid wages.

- The proportional amount of the year-end bonus (aguinaldo).

- Accrued vacations not taken by the employee.

- Vacation premium; and

- any other benefit accrued that has not been paid to the employee.

Severance Package for a Voluntary Resignation in Mexico

Under the scenario of a voluntary resignation, the employer shall pay:

- the Default Severance Package or finiquito payment, and

- a seniority bonus (i.e. prima de antigüedad) equivalent to 12 days of salary per year worked, provided that the employee has 15 or more years of seniority with the employer.

Severance Package for A Dismissal with Just Cause

Under the scenario for dismissal with just cause, the employer shall pay:

- the default severance package or finiquito; and,

- the seniority bonus.

These items constitute “just cause” for termination of the employment relationship without liability for the employer. It is essential for employers to have a trusted and professional labor lawyer.

The Severance Package for a Dismissal Without Just Cause in Mexico

Under the scenario for dismissal without just cause, the employer shall pay the following severance package:

- the Default Severance Package or finiquito.

- Ninety (90) days of salary;

- 20 days of salary per year worked; and,

- the seniority bonus.

Severance Package For Termination with Just Cause on Behalf of the Employee

Under this scenario, the employer shall pay:

- the default severance package or finiquito.

- Ninety (90) days of salary when the employee claims compensation, or 20 days of salary per year worked when the employee claims reinstatement but the employer denies the reinstatement; and,

- the seniority bonus.

What is the Seniority Bonus in the Severance Package?

As a result of a severance package, an employer may have to pay a Seniority Bonus in Mexico (or prima de antigüedad) equivalent to 12 days of salary.

The relevant daily wage of the seniority bonus is capped to the double of the applicable minimum daily wage (e.g. 246.44 pesos per day in 2020). In other words, the employee’s daily salary level may be disregarded when his or her daily wage exceeds the double of the applicable minimum daily wage.

USMCA Labor Chapter & Unions

The USMCA Labor Chapter and its Effects in Mexico

The US-Mexico-Canada Free Trade Agreement (USMCA) redefines what constitutes a modern free trade agreement because not only does it include non-trade disciplines, such as Chapter 23 – Labor (hereon “Labor Chapter”), but also novel “enforcement” mechanisms. USMCA entered into force on July 1st, 2020, and its Labor Chapter introduces binding commitments on the following internationally labor rights:

- freedom of association and the effective recognition of the right to collective bargaining;

- the elimination of all forms of forced labor;

- the effective abolition of child labor;

- the elimination of discrimination in respect of employment and occupation; and

- acceptable working conditions, i.e. minimum wage, working hours, and safety and health in the job.

In addition, the labor chapter includes provisions that USMCA parties must effectively address any incident of violence against workers when exercising their rights; to protect migrant workers under their local laws; as well as to protect workers against discrimination on the basis of gender, pregnancy, sexual orientation, gender identity, and caregiving responsibilities; provide job-protected leave for birth or adoption of a child and care of family members, and protect against wage discrimination.

Labor Mexican Amendment: Unions and Collective Bargaining

As a result of USMCA’s Labor Chapter, in particular Annex 23-A, as well as the approval of Convention 98 of the International Labor Organization, Mexico carried out a Labor Law Reform seeking to comply with its international commitments. Published on May 1, 2019, the Labor Law Reform focuses on provisions related to the freedom of association, unions, collective bargaining, among other matters.

What Are Protection Contracts and “White Unions”?

A protection contract is a collective labor agreement executed between a company and a union, normally, before employees are hired. These unions are commonly referred to as “White Unions.”

Foreign investors may find this situation quite strange and wonder:

Why should a company enter into a collective labor agreement without having employees?

The answer, in fact, is quite simple. Companies cannot carry out their productive activities while facing a strike challenge, and a protection contract is a legal tool to prevent possible strikes on behalf of a “union”, which is, of course, non-dominant.

The Problem of Protection Contracts and White Unions in Worker Representation in Mexico

Protection contracts have been an issue for workers that have sought for worker representation or to enforce their collective labor rights in Mexico.

On the one hand, the law previously authorized only one union per company and, on the other hand, the “union” may have no interest in representing the worker because it had a protection contract.

As a result, the workers are forced to form a union, challenge the dominance of the other union in the Conciliation and Arbitration Board, and win the legal challenge to be recognized as the dominant union to enter into collective bargaining negotiations and agreements.

The 2019 Labor Law Reform in Mexico

The Labor Law Reform seeks to prevent the so-called “protection” contracts and transform the labor environment in Mexico.

Is it still possible for new investments to have a “protection contract”?

The answer, as such, is no. New companies or investments cannot enter into “protection contracts” as described above since the law now requires that a majority of the employees to approve the collective labor agreements; in turn, the majority of the workers must also approve a strike challenge. Thus, strikes on behalf of non-existent unions or group of workers is, in theory, prevented.

In essence, the 2019 Labor Law Reform seeks to empower workers in the life of the union and the company, as well as reducing the employer’s interference in union activity. Consequently, employees of a company must be introduced to the union leadership, and the labor authority has the power of review and sanction, if necessary when a company or employer is not complying with these new provisions.

What Actions is Mexico Taking Right Now Regarding Unions and Collective Bargaining?

As of today, Mexico is carrying out the following actions in order to properly implement the Labor Law Reform and comply with USMCA’s labor chapter:

- the creation of the Coordination Council for the Implementation of the System Reform of Labor;

- the creation of working groups at a State level to implement the Reform;

- the publication of the Existing Collective Labor Agreement Legitimization Protocol;

- the establishment of the Federal Center for Conciliation and Labor Registry, State Conciliation Centers, Federal Labor Courts, State Labor Courts;

- The disappearance of the Conciliation Boards and Arbitration is still pending.

It is noteworthy that the Federal Center for Conciliation and Labor Registry, State Conciliation Centers, and courts will enter into operations through phases per the implementation of the so-called “New Labor Model”.

The first 10 states, such as Guanajuato, San Luis, State of Mexico, will begin the implementation of the New Labor Model by the end of 2020. The transition towards this new labor regime will conclude, in theory, in 2022, but this transition is already being delayed as a result of COVID-19.

Our Most Popular Guides

IMMEX Program

The IMMEX program is, to a great extent, used by companies within the manufacturing industry. In this guide, IMMEX experts provide a general overview of the IMMEX program and other trade instruments.

Taxes in Mexico

In this tax guide, our tax experts explain the income tax for individuals as well as the corporate tax rate. We also explain when Tax authorities consider that foreigners have a source of income in Mexico.

Starting a Company in Mexico

Our contributors explain the 12 steps to set up a company in Mexico. In this business guide, we also explain the different types of legal entities and other business models.

Foreign Investment in Mexico

As a general rule, all sectors of the economy are open to foreign investors unless Mexico's Foreign Investment Law provides restrictions. In this guide, our experts inform those foreign investment restrictions on land, activities, and certain legal entities.

Get In Touch With Us!

Phone

+ 52 55 1683 2289

info{@}doingbusiness-mexico.com

Address

Rio Churubusco 601, Col. Xoco, Benito Juarez, Mexico City.