Import Taxes and VAT in International Sales

Some foreign companies are facing difficulties to make international sales with their Mexican clients because of customs and tax matters, such as import taxes and VAT. For instance, a Mexican company may request the foreign company to deliver the good in their premises or warehouse in Mexico. As a result, the foreign company is responsible of importing the goods to Mexico and is left with these and more questions: who will be the importer of record? What are the applicable taxes? Are there any other possible options to avoid these taxes and paperwork?

Foreign Companies Delivering Goods in Mexico .

In this post, I will explain the customs and tax implications of an international sale where a Mexican company requests a foreign company (without any branch in Mexico) to deliver the goods in Mexico. This term of sale is known as Delivered Duty Paid, or DDP Incoterm. For clarity purposes, the foreign seller is responsible for transporting the goods from a foreign country, paying import taxes and/or customs clearance, and delivering the goods to the buyer.

The purpose of this post is to inform whether this term of sale is a reasonable taxwise and logistics option. I will also share relevant information that can be used in a negotiation.

Import Taxes and Customs Duties in Mexico

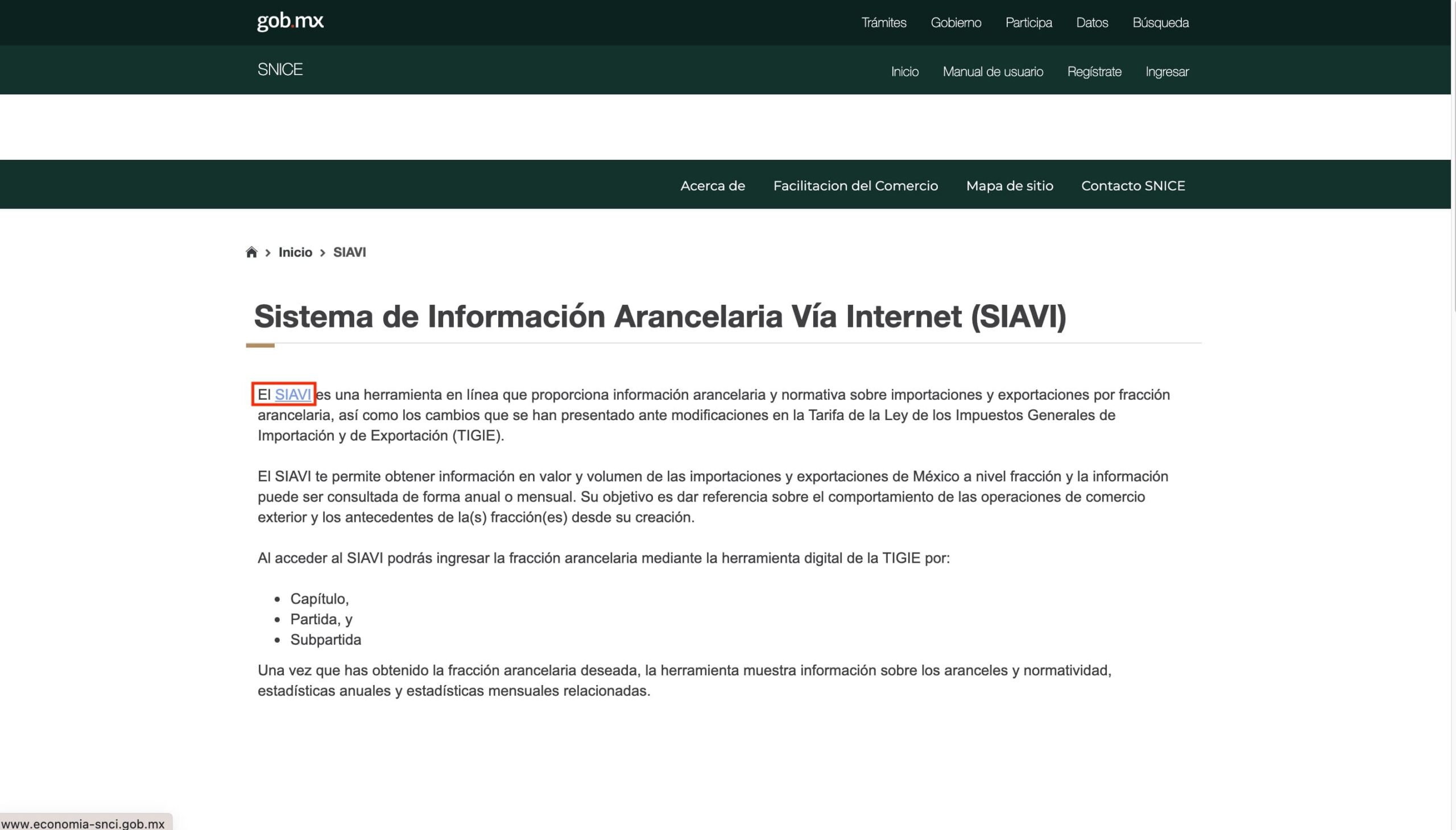

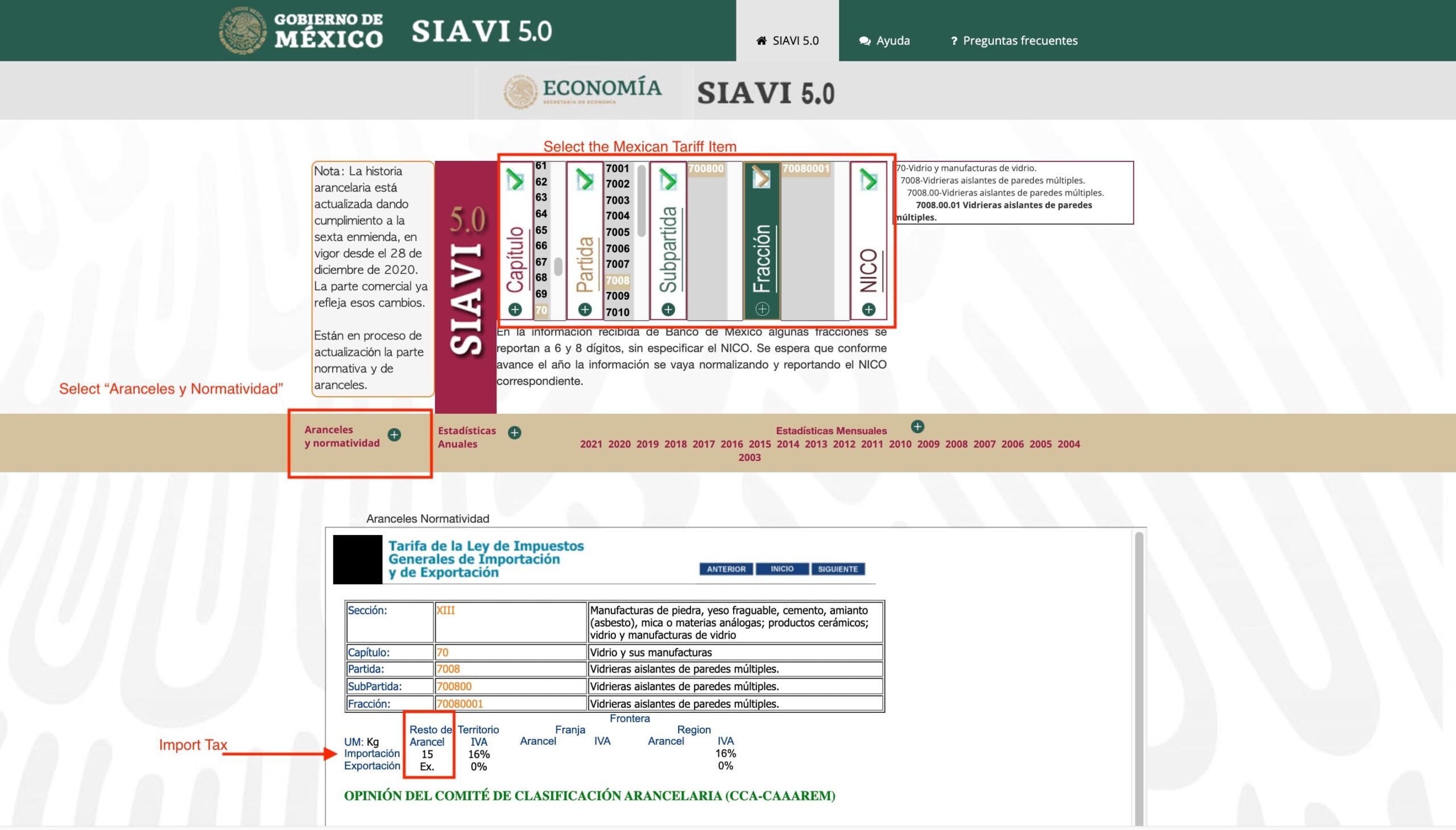

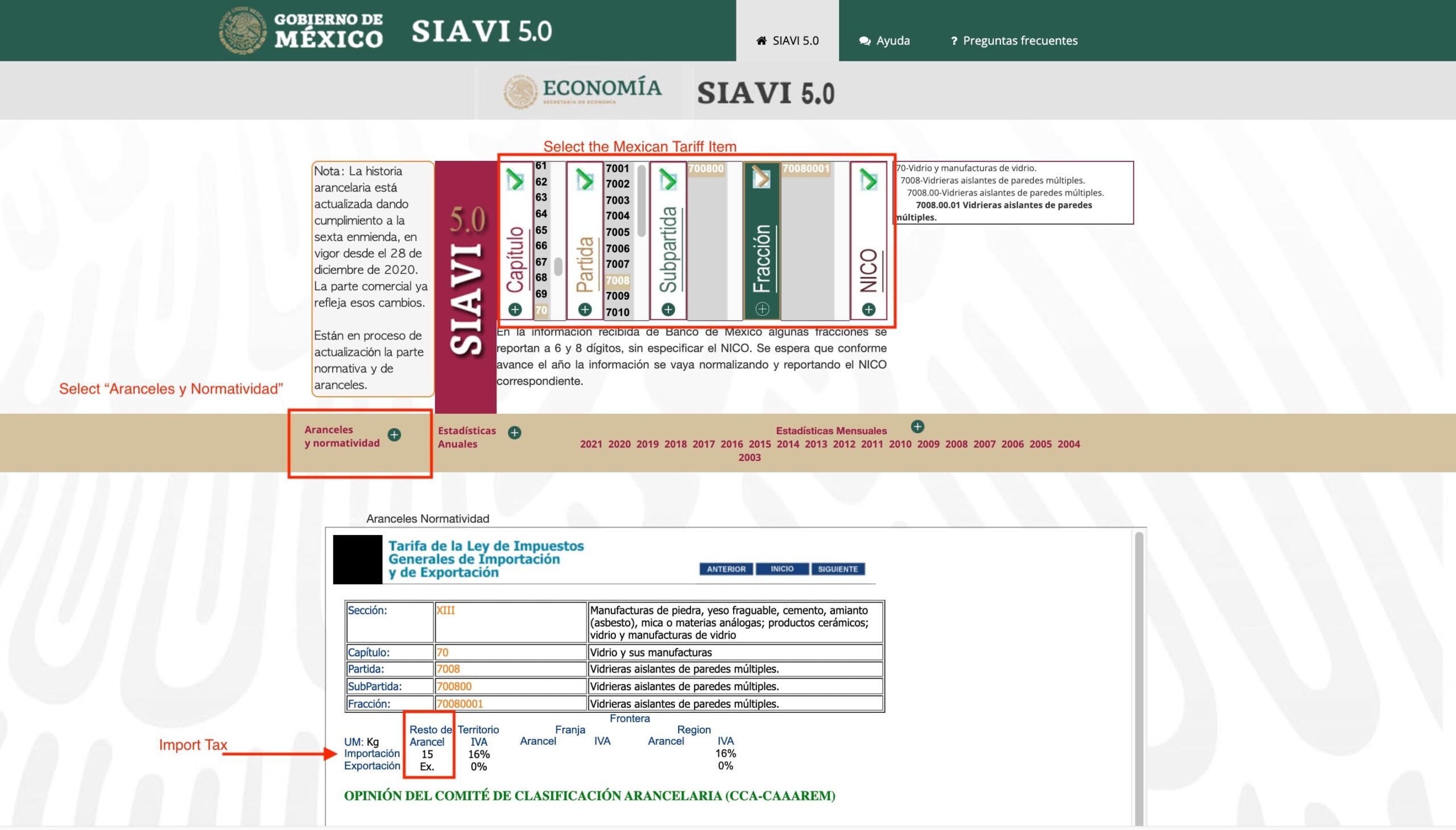

As you may be aware, goods imported into a country are subject to import taxes or customs duties. Mexico is no exception. To determine what are the import taxes, you need to know which is the Mexican Tariff Item, known as Fracción Arancelaria (which is an eight-digit code). A foreign tariff item, say from the US, European Union, China etc., may prove to be useful to have an idea what may be the applicable Mexican Tariff Item and, consequently the import tax. However, a detailed analysis is always required because not only import taxes may change between tariff items, but also customs and non-tariff barriers.

Mexican Import Taxes and Tariffs

As noted in DMB international trade guide, Mexico has an average of 14.3% import taxes for agricultural products, while 4.6% for non-agricultural products.

In 2020, the Mexican Government updated the “Mexican Tariff Item list“, or better said the Law on Import and Export Taxes. However, please note that this list and duties are subject to constant changes.

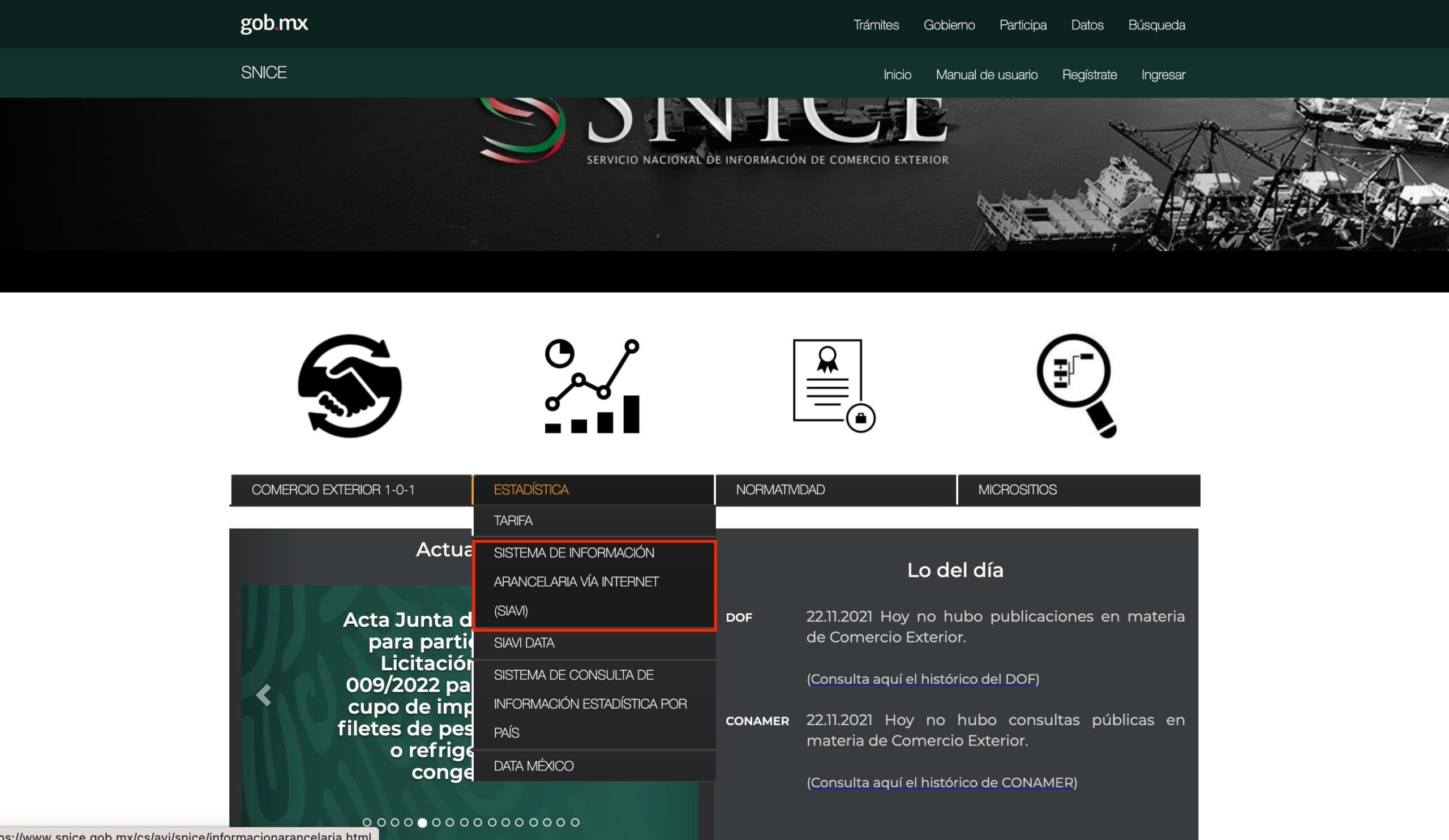

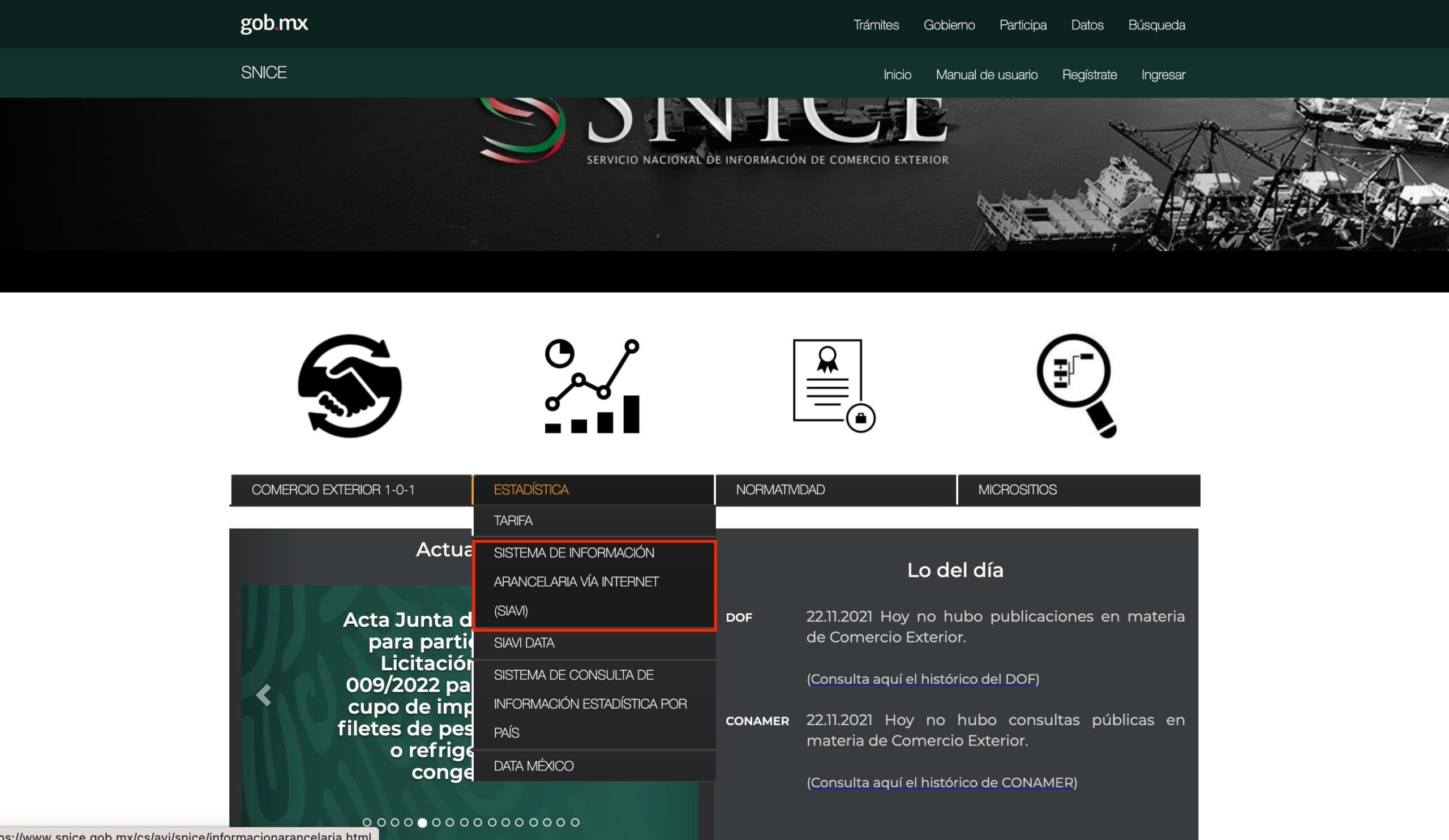

You can also visit the website “National Service Information of International Trade” managed by the Ministry of Economy. In the images below, I will show how you can find the information regarding import taxes. Needless to say, this website may take time to update any tariff changes, so please use it with caution.

Certifications of Origin and Free Trade Agreements.

Now, if your product has a certificate of origin due to the United States-Mexico-Canada Agreement (USMCA) or another Free Trade Agreement, the good may not be subject to import taxes or duties in Mexico provided that the applicable rules of origin are met.

It goes without saying that companies should always consult with a specialist on these matters.

Example: Tariffs

Tariff Calculation

VAT upon importation.

Example: VAT

VAT Calculation

Other Taxes

Now, it is possible that another VAT rate may apply depending on the product, for instance, medicines, food products, fertilizers, etc. Another special tax, known as IEPS, may also apply when importing specific products (such as alcohol, tobacco products, among others.). For more information on this matter please visit DBM’s guide on international trade and tax.

Summary: Import Duties, VAT and Other Taxes

Import Taxes: Customs value * 5% (or applicable rate).

Customs processing fees: Customs value * 0.008

VAT Importation: Customs value + Import duty + Customs

Can a foreign company be the importer of record in Mexico?

Short Answer: No !

In simple terms, a foreign company without a Mexican branch will face a handful of customs, tax, and logistic hurdles to deliver goods in Mexico. For starters, Mexico does not offer the possibility to foreign companies or residents to become a “non-resident importer” and be responsible for customs clearance, unlike other countries or jurisdictions.

In-Bond Warehouse.

However, it is possible for a foreign company to ship the goods to an in-bond warehouse, where said goods are subject to a special customs regime. Here, the taxes are paid if the goods are imported definitively into the country by an importer of record.

Importer of Record

As a result, a foreign company will most likely not be able to be the importer of record and, thus, it will be unable to carry out the customs clearance. Why? The foreign company will not be registered in the Record of Importers (i.e. Padrón de Importadores), which is managed by the Mexican Tax and Customs Authority, that is SAT. To import goods in Mexico, companies need to be registered in said Record of Importers. It is a must.

What are the Alternatives ?

If your client does not want to be the importer of record, you have three options.

Option 1: 3PL services

3PL or logistic companies in Mexico will most likely reject to be an importer of record because there are significant tax and customs responsibilities. So, what are the most viable options?

Option 2: Local Branch

If you are planning to conduct business in Mexico and deliver the goods to your customers, considering establishing a Mexican branch or company may be the most suitable option. The Mexican branch or company can be the importer of record, provided it is subscribed to the Importers of Register, and carry out the customs clearance through a customs broker.

Of course, there are some customs and tax implications since the goods have to be transferred to the Mexican branch. Furthermore, the downside of this option is that the Mexican branch or company will have to pay taxes in Mexico.

Option 3: Independent Agent

A second option is that the foreign company executes an “independent agency” agreement with a Mexican company. This way the Mexican company, which will act as an independent agent, can assume the role of the importer or record. As a result, the foreign company will not have a branch or a permanent establishment in Mexico with tax implications. The downside is that the foreign company’s profit margin is reduced.

Delivering the Goods in Mexico and VAT

In addition to the VAT upon importation, a “second” VAT (e.g. 16%) will apply when the terms of the sale provide that the goods are delivered in Mexico. Given that the foreign company is not a tax resident in Mexico, the Mexican buyer has the responsibility to withhold the VAT tax from the sale.

Furthermore, if the goods are at an in-bond warehouse and the buyer becomes the importer of record by importing the goods, he will have to pay both VATs, i.e. the import VAT and the sales VAT.

Conclusion: Import Taxes and Terms of Sale

For starters, a foreign company that intends to make an international sale with a Mexican company must carefully consider the terms of sale established in the contract or relevant agreement. As noted above, there are significant tax and customs hurdles to clear customs and deliver the goods in Mexico if the foreign company does not have a local branch in Mexico.

It is clear that the DDP term of sale is very favorable for a Mexican company, and there may be a couple of reasons as to why a Mexican company wants such a term of sale. For instance, the Mexican company may wish to avoid paying import taxes, VAT upon importation as well as the customs and tax responsibilities resulting of customs operations, the Customs Authorities may have even suspended the company’s subscription to the importers of record, among other potential reasons.

In short, a foreign company without a branch in Mexico should avoid agreeing to deliver goods in Mexico.

Disclaimer

Please note that there are other customs and tax implications that may arise when importing goods, such as compliance with non-tariff barriers (e.g. labeling, certifications, etc.)