IMMEX Program

IMMEX Program

IMMEX Program and Maquiladora Industry in Mexico

What is the IMMEX Program?

The IMMEX program is an import duty-deferral government program that provides benefits to authorized companies that engage in the manufacturing or maquila operation scheme in Mexico, including import-export. Consequently, a maquiladora is normally referred to as a company with an IMMEX program or IMMEX certification.

Before the IMMEX program, Mexico had other trade promotion programs (ALTEX, PITEX, ECEX, and Drawback) that established customs benefits to export-oriented manufacturing or maquila companies. These programs included benefits such as import duty deferral, speedy VAT refund, among other customs facilitation measures.

Needless to say, these programs are no longer available to new companies since the North American Free Trade Agreement (NAFTA) and its article 303 introduced rules and limitations on import duty deferral mechanisms. As a result, Mexico re-designed its trade programs, creating the IMMEX program (as well as the Sector Promotion Program (PROSEC).

The IMMEX program was originally established in a Presidential Decree in November 2006, and it has been subject to amendments.

What is a Maquila Operation?

According to the IMMEX Decree, the “maquila operation” is “the industrial or service process intended to manufacture, transform or repair foreign goods temporarily imported that are later exported or to provide export services.”

Who can access the IMMEX Program?

Only companies that are “residents” in Mexico may access the IMMEX Program per Federal Tax Code and the Income Tax Law.

Access the Legal Documents of the IMMEX Program

Benefits of IMMEX program and Maquiladoras

The IMMEX benefits aim to create an attractive regulatory framework for the export-oriented manufacturing industry; in other words, IMMEX companies can carry out manufacturing activities with temporarily imported goods in a low tax or tariff environment, but upon the condition that the imported goods are exported after being subject to production or some service.

1. Import Duty-Defferal

The IMMEX Program grants administrative facilitation measures and tariff incentives to manufacturers. Notably, IMMEX companies are authorized to introduce goods under the temporary importation customs regime, deferring (avoiding) the payment of import duties or the General Import Tax (known as IGI in Spanish acronym) in Mexico, and where appropriate, antidumping and countervailing duties.

Normal Company (without IMMEX program)

Import in Mexico (Definitive)

Pay Import Duties

Company with IMMEX program

Import in Mexico (Temporary)

No Import Duties

Export

Time Factor

Maquila Operations

with imported goods

What is the top benefit of the IMMEX program?

The benefit of the IMMEX Program allows the company, for instance, to manufacture or repair products in Mexico preserving the cash flow since the import duty is not paid, and using excellent and low-cost labor.

What about VAT / IVA tax upon Importation?

All imports are subject to VAT or the IVA tax, and in some cases IEPS. However, IMMEX companies may apply for the IVA/IEPS certification or a bond in order to “avoid” paying the VAT or IVA tax.

How much time can temporal imports stay in Mexico?

The temporal imports of IMMEX companies cannot exceed their legal stay in Mexico as follows:

Inputs, parts, components, and packaging can stay for 18 months.

Trailer boxes and containers can stay 2 years.

Machinery and equipment can stay in Mexico indefinitely or throughout the validity of the IMMEX program.

2. Income Tax Incentive

Foreign-Owned IMMEX only

The Mexican Income Tax Law provides a general 30% corporate tax rate. However, the Income Tax Law also has a provision that lists requirements so that a foreign-owned IMMEX company can benefit from a special tax regime provided that the legal structure of the business meets the “maquiladora” definition for tax law purposes.

An IMMEX company solely owned by “foreign tax residents” and that meet the tax requirements are considered by the trade community as a “pure maquiladora“. The owner, an individual or company, with the legal/economic relationships with the IMMEX company, will not have a permanent establishment in Mexico, provided that certain conditions are met.

Top Conditions for a Pure Maquiladora

Assets

Raw Material

The IMMEX company must use assets, such as the machinery, tools, instruments, molds, that are owned by the resident abroad or any foreign-related company. The raw material cannot be owned by the IMMEX company.

The owner of the assets has to be a tax resident in a country that has a Bilateral Tax Treaty with Mexico.

For more information, visit the Tax in Mexico Guide.

Bilateral Tax Treaty

3. Administrative and Customs Facilitation Benefits

IMMEX companies can benefit from facilitation measures as well as access to other government trade programs.

PROSEC

IMMEX companies in specific sectors can also obtain a PROSEC program to benefit from preferential import tariffs, according to their manufactured products or export services.

For more information on PROSEC, our International Trade guide.

Transfer Temporal Imports

IMMEX companies can transfer temporarily imported goods or the final manufactured products to other IMMEX companies and continue deferring the import duties.

Authorized Economic Operator

An IMMEX Company may also apply to be an Authorized Economic Operator (AEO) to, among other several facilities, extend the term of legal stay of the temporarily imported goods up to 48 months for raw materials, instead of the 18 months indicated in point 1.

Import Duties

When paying an import duty (if applicable), an IMMEX company may choose, if applicable, to apply any of the following applicable rates: (i) The General Import tariff, (ii) Preferential Tariff in a Free Trade Agreement, or (iii) the preferential tariff established in the PROSEC Program, provided that the company has the corresponding authorization.

Sub-Manufacturing

IMMEX companies can register a non-IMMEX third party in their IMMEX authorization for sub-manufacturing operations purposes. In such event, the IMMEX company can transfer the temporarily imported inputs to said non-IMMEX third party to perform or even complement (quantity) its production process, while still deferring the import duties. The IMMEX company is responsible for the compliance, including the compliance on behalf of the third-party.

IVA-IEPS Certification

VAT is applicable to imports, including temporal imports of an IMMEX Company. However, an IMMEX company may also apply for a VAT/IEPS Certification, which allows having a “tax credit” equivalent to the VAT and/or IEPS tax applicable to the temporary imports. With this certification, the IMMEX company can avoid paying VAT when importing.

IMMEX Program and Maquiladora Requirements

How to Access the IMMEX Program?

The Ministry of Economy and the Ministry of Treasury, through the Mexican IRS (known as SAT, in Spanish), have joint responsibility for issuing the IMMEX authorization. However, the Ministry of Economy is the authority in charge of granting the IMMEX authorization or certificate to a company (hereon referred to as “IMMEX company”), while the Ministry of Treasury has to approve said company prior said authorization is issued. Thus, tax compliance is essential.

General IMMEX Requirements

- A facility to carry out the activities

- Employees

- Maquila contracts

- Assets

- Other requirements

IMMEX Progam Types

Industrial IMMEX

The Industrial IMMEX is the most common type of IMMEX program option, and it is granted to a company that uses imported materials and carries out an industrial manufacturing process or transforms goods for export.

IMMEX Holding Company

This modality is like the industrial modality, but it is for an industrial group that carries out the industrial process. The IMMEX program is granted to a certified company, called the “holding company”, and one or more companies that are integrated into the manufacturing operation and controlled by the holding company.

IMMEX Services

This modality is for a company that performs services for the process of producing goods for export or carries out export services. These IMMEX companies have additional limitations to import sensitive goods.

IMMEX Shelter

Also known as IMMEX Accomodation, the IMMEX Shelter is for Mexican firms that offer maquila (or tolling) services to foreign companies, while the foreign companies will provide the technology and inputs without operating its own IMMEX company. In other words, the IMMEX Shelter company will import the technology, raw materials, and components supplied by the foreign company and will carry out the industrial activities according to a contract; the finished or semi-processed products are exported to the foreign company.

IMMEX Tertiary

This modality consists of a certified IMMEX company, that due to lack of appropriate infrastructure, carries out a manufacturing process through third parties registered under its IMMEX Program.

Do You Need A Trusted Advisor for an IMMEX Program?

Let us help finding you one.

Agency

Preparing and applying the relevant IMMEX formats and filing notices before the relevant authorities.

Preventive Audits

Through IT software, reviewing records to detect and minimize tax and customs contigencies.

Diagnosis

Reviewing the supply chain from a commercial, legal, logistics, and/or customs point of view.

Legal

Planning commercial, trade, customs & tax compliance, and representing the company before authorities.

IMMEX Requirements

Export Value

An IMMEX company has to perform annual export sales that amount at least $500,000 USD, or their billed exports must represent at least 10% of its total turnover.

IMMEX Compliance

IMMEX companies can exclusively use the temporary import regime for the goods authorized in its IMMEX Program and use said goods for the authorized purposes.

Exporting Temporal Imports

An IMMEX company must export or return the goods temporarily imported within the legal timeframes.

Annual Report

An IMMEX company has to submit electronically an annual report no later than the last business day of May to the SAT, to inform its total sales and exports of the previous tax year.

Statistics Reports

An IMMEX company has to submit information to the National Institute of Static and Geography (INEGI, Spanish acronym) for statistical purposes.

Tax and Customs

An IMMEX Company has to permanently comply with its customs and tax obligations

International Trade Regulatory Aspects

Importers's Registry

As noted in the International Trade guide, a company that seeks to import or export must register in the Importers’ Registry or Exporters’ registry that is managed by SAT’s General Customs Administration.

Appointment of a Broker

As an ancillary process to the Importers’ Registry, the IMMEX company must notify the SAT of the appointment of at least one customs broker, who shall be in charge of conducting the IMMEX company’s international trade operations.

Sensitive Goods

Footwear, apparel, textiles, steel, and aluminum products are “sensitive” products and, thus, are subject to additional regulatory control. IMMEX companies require to file for a “program extension” to import temporarily sensitive goods.

Address Confirmation

Once the Mexican entity has been authorized to operate under an IMMEX program, the IMMEX company must again confirm to SAT its registered tax address as well as any other address where its manufacturing operations are carried out.

Non-Tariff Regulations

IMMEX companies can exclusively use the temporary import regime for the goods authorized in its IMMEX Program and use said goods for the authorized purposes.

IMMEX Program Suspension and Cancellation

Not Complying with Customs and Tax Obligations

IMMEX with tax liabilities greater than $400,000 pesos due to customs infractions.

SAT initiates government procedure to recover Tax liabilities.

IMMEX Information is false, non-existent, or not verifiable.

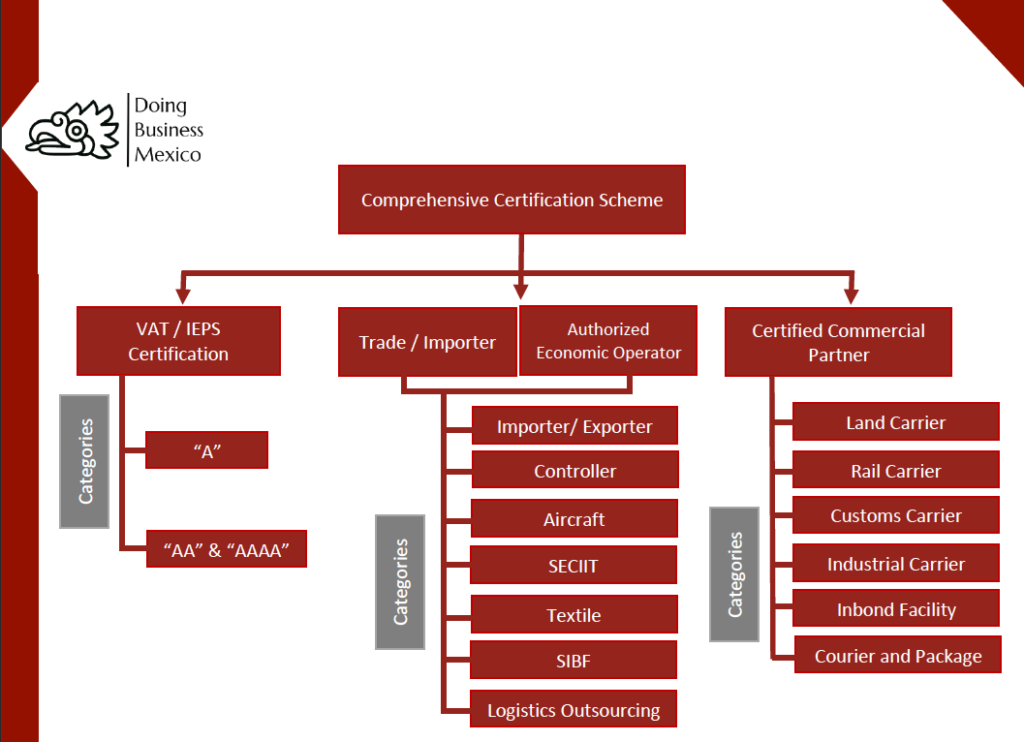

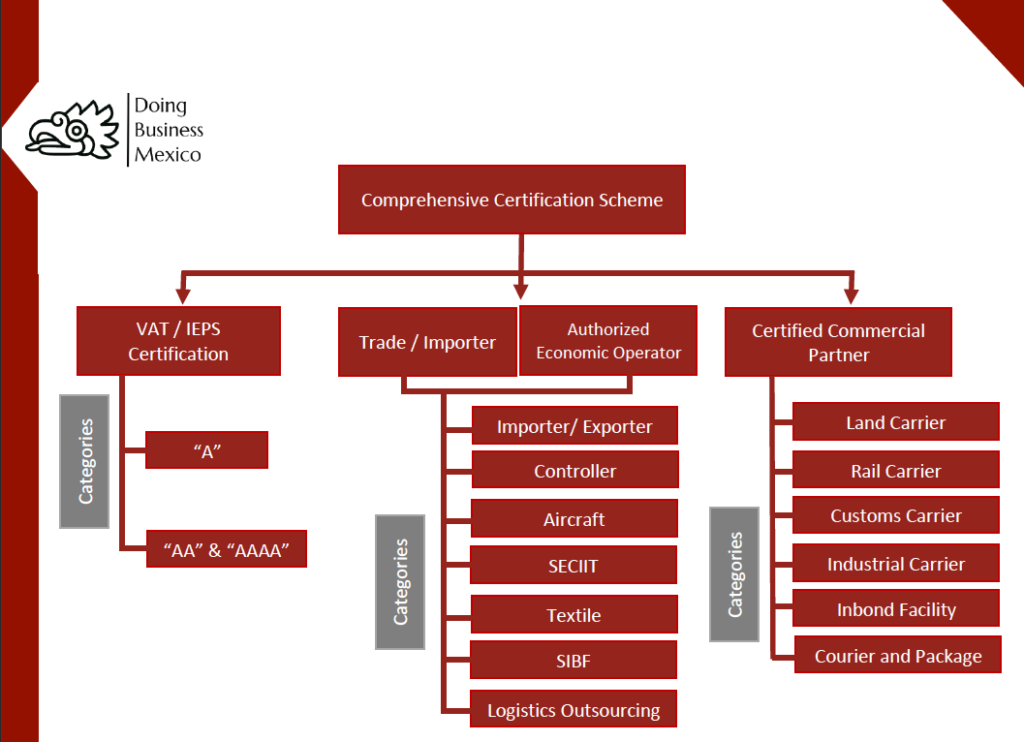

Comprehensive Certification Company Scheme

In Mexico, SAT International Trade Rules establish a “Comprehensive Certification Scheme” for companies that carry out foreign trade operations providing several facilitation measures to make them more competitive.

The Comprehensive Certification Scheme consists of several types of certifications according to the role a company plays in the logistic chain, each certification has different modalities or levels that entail different requirements, obligations, and benefits.

The following diagram includes all certifications.

Needless to say, the most relevant certifications are the VAT/IEPS Certification and the Authorized Economic Operator, and we will explain key aspects of these certifications below.

VAT/IEPS Certification

As noted in the International Trade Policy Guide, imported goods are normally subject to VAT and IEPS, when applicable, including goods subject to the temporary importation customs regime. However, an IMMEX company, for instance, may apply to obtain a VAT/IEPS certification to avoid paying said taxes when importing goods under the temporary importation customs regime.

SAT is the authority in charge of authorizing whether an IMMEX company is granted or not the VAT/IEPS Certification. The VAT/IEPS certification is available to any company that imports goods under the following customs regimes:

- Temporary Importation (e.g. IMMEX company);

- Elaboration, Transformation or Repair in an Inbond Facility;

- Strategic Fiscal Precinct; or,

- Tax Warehouse to undergo the vehicle assembly and manufacturing process, to companies in the terminal automotive industry.

In addition to “avoiding” VAT/IEPS upon importation, the VAT/IEPS Certification grants additional benefits, such as the possibility to import “sensitive goods” as raw materials among other benefits dependent upon the industry of the IMMEX company.

How does the VAT/IEPS certification work?

In essence, an IMMEX company with a VAT/IEPS certification has a tax credit equivalent to the payable VAT/IEPS tax resulting from the temporary import of goods. The VAT/IEPS certification, in other words, functions as a tax deferral program, whereby the certified company must export the goods temporarily imported within the legal period to avoid paying the applicable VAT/IEPS (as well as the Import Duty, of course).

Different VAT/IEPS certification?

SAT has established different categories or modalities of the VAT/IEPS certification: A, AA, and AAA. Apart from specific requirements regarding the IMMEX company’s machinery/equipment value and the number of employees, the only difference between modalities is the duration of the certification i.e. one, two, and three years respectively.

General Requirements to Obtain VAT/IEPS Certification

The following table includes the General Requirements to obtain the VAT/IEPS certification. These requirements are specific to VAT/IEPS Certification, while other requirements apply to the IMMEX Program. An IMMEX company with VAT / IEPS certification must, of course, comply with both requirements.

- The company must have up to date its tax records and in compliance with its tax obligations, including partners or shareholders.

- The company must request a positive tax compliance opinion from SAT.

- The company must have valid its “ tax digital stamps” (CFDI).

- The company must have updated its online tax mailbox.

- The partners, shareholders or legal representatives have not received a complaint or criminal accusation in the last 3 years.

- The company must maintain its electronic accounting in the SAT’s website or portal, and submit its monthly accounts to SAT.

- If the IMMEX company has national suppliers, it must register them in its Program and permanently ensure they have a positive tax compliance opinion from SAT.

- The Company must pay a yearly government fee to obtain the Certification.

- The company must prove the legal possession of the facilities where the production processes will be carried out.

- The legal representative must have the powers or authority to execute ownership acts or deals.

- The company must have up to date its customs records and in compliance with its customs obligations.

- The company must not be suspended in the Importer’s Registry or the Importer’s Registry of Specific Sectors or Sectorial Exporters Registry.

- The company must allow, at all times, initial inspection visits from the Customs Audit Authority.

- The company must have clients and suppliers abroad that are linked, directly or indirectly, to the customs regime for which it is requesting registration.

- The company must maintain electronic inventory control.

- The partners/shareholders or a management individual cannot be related to a company whose VAT/IEPS or OEA certification has been canceled.

- The company must have personnel registered before the Mexican Institute of Social Security (“IMSS”, Spanish acronym) or through subcontracting workers.

- The company must comply with the obligation to withhold and pay the income tax of its workers.

As mentioned above, an IMMEX company can obtain VAT/IEPS certification either “A”, “AA” or “AAA” modality or category depending on its operational years, the value of machinery and equipment as well as its number of workers.

VAT/IEPS Certification Benefits and Requirements

In addition to the general requirements listed in the previous section, a company interested to obtain a VAT/IEPS certification must meet a long list of requirements, including the main requirements listed below depending on the modality. If granted, the company would enjoy the listed benefits. The International Trade Rules provide special provisions applicable to “sensitive goods” imports.

Benefits of Modality “A” Certification

The company can apply a tax credit equivalent to the VAT/IEPS applicable to its temporary imports.

Requirements

- Have at least 10 workers registered before IMSS or through outsourcing.

- Have the infrastructure to carry out its operation.

- Not have suppliers listed by SAT as nonexistent or with nonexistent operations.

- Have a maquila, sale, contract, purchase, or services order that proves the continuity of the export project.

- In the last 12 months, the IMMEX company must have imported inputs under the temporary customs regime and that final or manufactured good’s value should represent at least 60% of said inputs’ value. Or have returned at least 60% of its total temporary import value.

Benefits of Modality “AA” Certification

An Industrial IMMEX will automatically have authorized the IMMEX Services Option.

A VAT / IEPS company can request authorization for temporary import of “sensitive” raw materials without being subject to a volume limit or to request renewal every four months as an IMMEX company without VAT / IEPS certification.

Requirements

In addition to the requirements mentioned for Modality A, a company aspiring for AA certification must meet at least one of the following requirements or condition:

- Being authorized and having international trade operations during the last 4 years or more.

- Having over the last 12 months more than 1,000 workers registered in IMSS and/or through outsourcing.

- Having machinery and equipment exceeding 50 million pesos.

- SAT has not notified a tax or customs liability to the company in the last 12 months.

- SAT has not issued a decision denying a VAT refund to the company, whose amount represents more than 20% of the total authorized refunds and/or that the resulting denied amount exceeds 5 million pesos in the last 6 months.

Benefits of Modality “AAA” Certification

An Industrial IMMEX will automatically have authorized the IMMEX Services Option.

Requirements

In addition to the requirements mentioned for Modality A certification, a company must meet one of the following requirements:

- Being authorized and having international trade operations during the last 7 years or more.

- Having over the last 12 months more than 2,500 workers registered in the IMSS and/ or through outsourcing.

- Having machinery and equipment exceeding 100 million pesos.

- SAT has not notified a tax or customs liability to the company in the last 24 months.

- SAT has not issued a decision denying a VAT refund to the company whose amount represents more than 20% of the total authorized refunds and/or that the resulting denied amount exceeds 5 million pesos in the last 6 months.

1. A special benefit applies to electrical or electronic auto parts and/or aircraft sectors regarding air traffic operations/imports.

2. A Services IMMEX can change the customs regime to definitive for goods transferred by auto parts companies that are going to be used by the terminal automotive industry or manufacturing of motor transport vehicles.

3. Companies in the auto parts industry will be able to register in their inventory control system as returned the goods sold to companies in the terminal automotive industry or manufacturing of motor transport vehicles.

Authorized Economic Operator Certification (AEO) in Mexico

Mexico’s Authorized Economic Operator (AEO), a program promoted by the World Customs Organization, is designed for various actors that participate directly or indirectly in activities related to international trade operations. The AEO entails the implementation of minimum standards regarding security with the purpose to mitigate illicit acts that violate the security of the country.

Also, the AEO gives companies the opportunity, through a sort of self-audit or due diligence, to identify internal and external risks that may affect the security of a company’s supply chain and, eventually, establish measures to mitigate such risks.

In addition, if AEO certification is granted, the company has access to administrative facilitation measures applicable to international trade operations.

AEO Requirements

The interested company must satisfy the VAT/IEPS certification general requirements and the following specific requirements in order to obtain the AEO certification:

The company must have carried out international trade operations during the last two years before its application. An exception may apply to new companies of a group or resulting from mergers or divisions.

The company must designate its authorized transport companies for imported goods.

The company must comply with a “Security Profile” consisting of several security standards and processes in each of the facilities where its operations are carried out. The company’s Security Profile requirements will depend on the AEO modality, i.e.: Importer/Exporter, Controller, Aircraft, Custom Broker, or Carrier, among the other categories listed in the Comprehensive Certification Scheme diagram.

Benefits of Authorized Economic Operator

In general terms, a company with AEO certification will benefit from being perceived as a highly reliable and trustworthy company, an efficient supply chain, as well as the following facilitation measures:

- Expand the legal stay period regarding inputs imported under a temporary importation customs regime. As noted in section IMMEX program Benefits, an IMMEX company can have foreign inputs, components, and raw materials imported temporarily for 18 months; however, an IMMEX company with AEO may have such goods for 36 months (or up to 48 months on the SECIIT category).

- When importing, the AEO does not have to transmit or provide the “Manifestation of Value” (Customs value worksheet).

- Using the exclusive “express” lanes for the customs clearance for imported goods.

- Facilitation measures for the regularization of not declared or leftover goods.

- The possibility to change all temporary imports into the definitive importation customs regime in a single import notice (i.e. pedimento).

- Avoid recording or including serial numbers, part, brand, and model in the import notices (i.e. pedimento) or corresponding import documents when carrying out customs clearance.

- Not requiring authorization to rectify import notices (i.e. pedimento) within 3 months of the importation.

- Right to a preliminary procedure before being suspended from the Register of Importers.

Needless to say, this list is not exhaustive and a company with AEO certification enjoys additional facilitation measures some depending on its category.

Sector Promotion Program (PROSEC) and Eight Rule

As we noted in the International Trade guide, PROSEC and the Eight Rule are Production Promotion Instruments. IMMEX companies may request the PROSEC authorization to be allowed to import various goods to be used in the elaboration of specific products of certain industries with a preferential ad-valorem tariff (general import tariff).

At the same time, authorized PROSEC companies can also benefit from the “Eight Rule”, or Regla Octava in Spanish. A company would need to apply for an import license granted by the Ministry of Economy to import goods under Mexico’s tariff sub-heading 98.02 “special operations”. If granted, the company may import supplies, materials, parts, components, machinery, equipment, including packaging material and packaging, and, in general, those for the elaboration of the final products under its PROSEC.

Another benefit included in the PROSEC Program is facilitation on non-tariff barriers compliance since some regulations (NOMS) can be avoided during the importation of covered inputs.

Click for More Information on International Trade Guide

Non-Tariff Barriers

Automatic and Non-Automatic Import Licences Applicable in Mexico.

Customs

Everything you need to know to import or export in Mexico.

Why Mexico?

Why Investing in Mexico?

What is the current political and economic environment in Mexico?

Competitiveness Ranking

A summary regarding Mexico's positive and negative indicators according to the World Bank and the World Economic Forum.

Land for Industry

What you need to know when purchasing or leasing land for industrial purposes in Mexico.

Security in Mexico

An honest review of the security situation for businesses in Mexico.

How to do business in Mexico?

The Mexican Legal Guide

How to create a company in Mexico?

Under this section, Doing Business Mexico explains the 12 steps to create a company in Mexico, including the basic legal features of the two most relevant types of companies as well as other possible business structures.

Visit our guide: How to create a company in Mexico?

Do Foreign Investment Restrictions Apply in Mexico?

As a general rule, all sectors of the economy are open to foreign investors unless otherwise provided in Mexico’s Foreign Investment Law. Although through the years sectors have been liberalized, Mexico has still foreign investment restrictions in place that are applicable to specific activities as well as restrictions on land ownership.

Visit our guide: Foreign Investment in Mexico.

International Trade in Mexico

Being a WTO member and having 13 Free Trade Agreements, Mexico is a country that is open to international trade. In this guide, topics such as tariffs, preferential tariffs, import restrictions, customs procedures, Free Trade Agreements like USMCA, among other matters, are reviewed.

Visit our guide: International Trade in Mexico.

The IMMEX Program and the Mexican Manufacturing Industry

The export-oriented manufacturing industry, also known as the maquiladora industry, represents one of the most important pillars of the Mexican economy. The IMMEX program is, to a great extent, used by companies within the manufacturing industry. In this guide, Doing Business in Mexico provides a general overview on the IMMEX program.

Visit our Guide: The IMMEX Program.

Taxation in Mexico

What are Mexico’s main taxes? What is the corporate income tax rate or Mexico’s VAT? When a foreigner creates a permanent establishment in Mexico, or is considered a resident for Mexican tax purposes? In this guide, Doing Business in Mexico explores the common questions that a foreigner has about Mexican Taxes.

Visit our Guide: Taxation in Mexico.

Get In Touch With Us!

Phone

+ 52 55 1683 2289

info@doingbusiness-mexico.com

Address

Rio Churubusco 601, Col. Xoco, Benito Juarez, Mexico City.